2015 – How am I doing?

Well dividends are varied, some of the companies have dropped their dividend payouts and that has hit my income returns. I have continued to buy shares periodically to build a small portfolio of shares alongside my NISA investment funds (index and low fee funds).

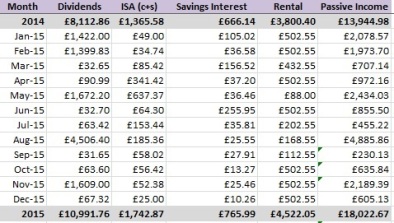

Below is my income update (Dec 2015):

My income is gross so tax is payable on these at the end of the year. The more I can keep in tax-free accounts the better. Happy with progress so far this year.

For Mar-15 & Apr-15 – Have been lean times for dividends. I could do with finding some income generated shares which pay out during this month to help supplement my income.

For May-15 I received a good dose of dividend income and as you can see, I have a void period on my BTL so am not receiving any income from this stream at the moment.

**** I quit my job in May, so I now have no salary income to draw upon and now need to see how my passive income will support me while I take some time out and determine what I do next….

For Jun-15 my rental income had returned as I now have a new tenant in the property. There are a few maintenance bills to come which will need to be settled but at least the income is now back on track.

For Aug-15 I received a pretty sizeable dividend payment which now means I have almost matched last year’s total income.

For Sep-15 my income has dropped off and the ISA seems to have dropped off completely. I guess I am just invested in shares that don’t pay out this month. If I build on some of the shares that pay dividends in March, June & September I could possibly level out the income stream.

For Oct-15 my rental income picked up again as I have finished paying out for maintenance works required on the property. The tenant has also renewed for another 6 months.

For Nov-15 my dividends picked up again as I received yet another special dividend payment from shares I own. This means I don’t need to draw from my cash fund as I can use the dividend income to live this month.

For Dec-15 I have forecast my income based on dividends already received and rental income expected. My savings income should come in at about £25 and I am hoping that my ISA income from the newly converted funds will still provide about £50 per month.

Overall, I am quite impressed that I have managed to increase my passive income. Ok, there is some tax payable on this but gaining an extra £5k this year through purchasing more shares/re-investing and special dividends has been a good motivator. I hope to continue to increase my income stream next year.